Hsmb Advisory Llc for Beginners

Hsmb Advisory Llc for Beginners

Blog Article

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Table of ContentsSome Known Incorrect Statements About Hsmb Advisory Llc Our Hsmb Advisory Llc IdeasThe Ultimate Guide To Hsmb Advisory LlcRumored Buzz on Hsmb Advisory Llc

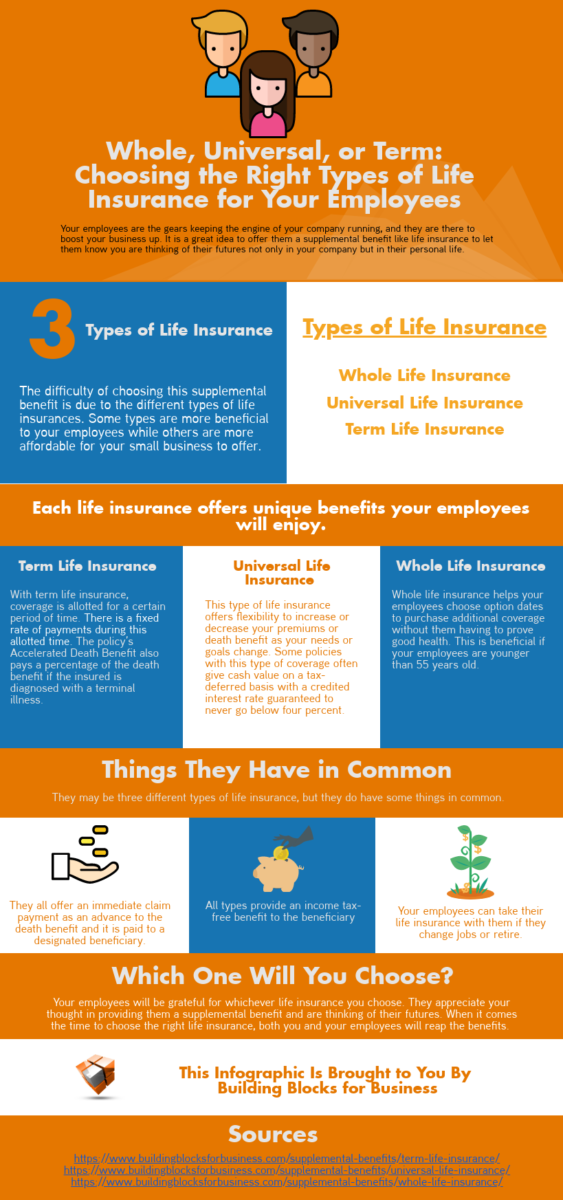

Life insurance is specifically crucial if your family members is dependent on your income. Market specialists recommend a policy that pays out 10 times your yearly income. These might include home mortgage settlements, exceptional fundings, debt card financial obligation, tax obligations, kid treatment, and future college expenses.Bureau of Labor Stats, both spouses functioned and generated earnings in 48. 9% of married-couple households in 2022. This is up from 46. 8% in 2021. They would be likely to experience financial difficulty as an outcome of one of their breadwinner' deaths. Wellness insurance policy can be gotten via your company, the government medical insurance marketplace, or personal insurance policy you purchase for yourself and your family by getting in touch with health and wellness insurance policy companies straight or experiencing a wellness insurance policy representative.

2% of the American populace was without insurance protection in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Data. Greater than 60% got their coverage through an employer or in the personal insurance policy market while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' advantages programs, and the federal marketplace developed under the Affordable Care Act.

The Ultimate Guide To Hsmb Advisory Llc

If your income is reduced, you may be one of the 80 million Americans that are eligible for Medicaid.

According to the Social Security Administration, one in four workers getting in the workforce will end up being disabled before they get to the age of retired life. While health and wellness insurance coverage pays for hospitalization and medical bills, you are often strained with all of the expenditures that your income had actually covered.

This would certainly be the very best alternative for protecting economical handicap protection. If your employer does not use long-term protection, right here are some things to consider prior to buying insurance on your own: A plan that guarantees revenue replacement is optimum. Numerous policies pay 40% to 70% of your income. The expense of handicap insurance is based upon numerous factors, consisting of age, lifestyle, and wellness.

Before you get, review the small print. Numerous plans need a three-month waiting period before the coverage starts, supply an optimum of 3 years' worth of protection, and have substantial plan exemptions. Regardless of years of improvements in automobile safety and security, an approximated 31,785 people died in website traffic accidents on U.S.

9 Simple Techniques For Hsmb Advisory Llc

Comprehensive insurance covers theft and damage to your vehicle due to floods, hailstorm, fire, criminal damage, dropping things, and animal strikes. When you finance your car or rent an automobile, this kind of insurance is necessary. Uninsured/underinsured driver () insurance coverage: If an uninsured or underinsured driver strikes your automobile, this protection spends for you and your guest's clinical costs and might additionally represent lost income or compensate for discomfort and suffering.

Employer protection is often the best try this web-site choice, yet if that is inaccessible, acquire quotes from several suppliers as numerous offer discounts if you acquire even more than one sort of coverage. (https://www.pubpub.org/user/hunter-black)

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Between wellness insurance coverage, life insurance coverage, handicap, obligation, long-term, and even laptop insurance policy, the task of covering yourselfand believing about the unlimited possibilities of what can happen in lifecan really feel overwhelming. As soon as you understand the fundamentals and make sure you're effectively covered, insurance coverage can improve financial confidence and health. Here are the most important kinds of insurance policy you require and what they do, plus a couple pointers to stay clear of overinsuring.

Various states have different guidelines, however you can expect health and wellness insurance policy (which lots of people get with their company), car insurance (if you possess or drive a lorry), and home owners insurance (if you have home) to be on the checklist (https://moz.com/community/q/user/hsmbadvisory). Necessary kinds of insurance policy can change, so check up on the most recent regulations every now and then, particularly before you renew your policies

Report this page